How to avoid trading emotionally by understanding trading psychology? Table of Contents

Why psychology when it comes to Forex trading?

The more you study human cognition, the more you will doubt what you once took for granted. You once thought that your thinking characteristics are completely rational, but it has been proved to be a huge cognitive blind spot. In fact, we are all troubled by this blind spot to a certain extent. Once you realize that your decision-making ability, your ability to classify input data, and even the accuracy of your own memory may be limited, you will understand how important it is to become a trader.

Imagine that you not only have to compete with such a powerful opponent as the market itself, but also face your untested cognitive biases and blind spots, and these biases and blind spots are the reason why you have failed to realize your potential. Suddenly, your education as a trader begins to undergo a strange and profound transformation, and you begin to understand that being outstanding requires a lot of self-effort. This is exactly what the trading psychology of this chapter will explain, revealing some common blind spots, and by introducing you to these blind spots, we can help you understand how they affect your trading.

Increased investment, often referred to as the sunk cost misunderstanding, is one of the more harmful cognitive blind spots that affect transaction performance.

In essence, the sunk cost misunderstanding and increase in input refer to the way we increase the level of input to a previous choice, even if that choice is not the best action. We don’t want to see the cost of this option as sunk (that is, money is spent). We tend to continue pursuing a certain way to prove that the previous choice was correct, rather than admitting that it was a mistake and making changes.

We are susceptible to this misunderstanding in all aspects of life. You must have experienced forcing yourself to finish a meal that you paid for, even if you really don’t want to eat it anymore, or after reading a book that you’ve read 200 pages but didn’t like.

Vince paid $1,000 to an indoor tennis club, which allowed him to play once a week during the indoor season. Two months later, he suffered from a tennis elbow, which hurt when playing. Not wanting to waste membership fees, he endured the pain for three months and didn’t stop until the pain became unbearable.

This is a good example of how perceptual distortion can cause a person to act in a completely irrational way, which is more harmful than accepting membership fees as a sunk cost in the long run. As Taylor said, it is very likely that if a friend invites him to another tennis club to play tennis for free, he will decline the invitation on the grounds of an elbow injury.

Chess is another particularly good example, it allows us to understand the world of trading more closely. Imagine that in a chess game, you manage to gain an advantage. You worked hard to cultivate this advantage and put your opponent in an increasingly difficult situation, but in the process, you made a wrong judgment and lost this advantage. Many players will still unconsciously stick to the old strategy to the point that they deceive themselves, believing that they still have an advantage, and continue to play in this way, even if the situation on the board has changed.

This kind of wrong persistence will make them unconsciously miss all kinds of opportunities, which is not in line with the specific strategy and will eventually lead them to make more mistakes and thus be at a greater disadvantage.

The same is true for trading. We often enter the market with a clear strategy and then begin to ignore all the signs that we may make a wrong judgment, but still stick to the original strategy, and the market is becoming more and more unfavorable for us.

Sometimes, a strategy may be successful at first, but then, for whatever reason, the direction of the market changes and is closely tied to our theory. We ignore the reversal and insist on waiting for the price to return to us. Favorable level.

Part of the reason for this irrational behavior is that humans perceive losses as twice as much as gains, which means that, in order to avoid losing money, we almost ignore a transaction that is rapidly out of control. We have no problem with closing profitable positions prematurely because even if doing so will lose potential profits, our psychology still allows us to treat this transaction as a victory.

Another thing to remember is that over time, the perception of sunk costs will diminish. Taylor conducted a demonstration. The case used Gourville & Soman’s research on gym attendance. They found that after members receive the bill, this number will rise rapidly, and then over time, this number will gradually decrease. , And the cost of membership is no longer so concerned.

So when you receive the bill, you will suddenly realize that you have to make the most of your membership fees, so you start to go to the gym regularly. Only as time goes by, you will gradually forget the money you paid, and you will return to laziness.

In other words, the longer you let the loss last, the easier it is to get used to new situations, and the easier it is to accept that a sudden price fluctuation will ruin your account.

All the materials in this trading psychology chapter are designed to make you think about your unconscious behaviors when trading. I hope you can be aware of these behaviors and reduce their impact on you. You can set strict stop-loss and take-profit levels, or make a strict plan before entering the market, and you can’t deviate from this plan on impulse. Recognizing these unconscious behaviors is the first step in correcting them.

Understanding the “Stock psychology”

Forex trading psychology

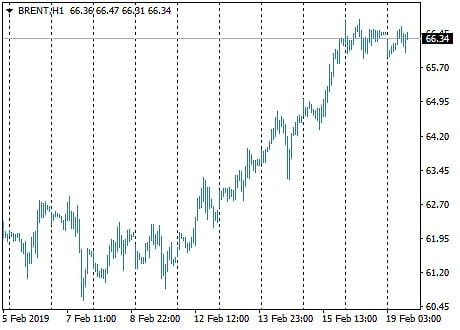

Open the charts of the financial instruments you frequently trade. Look at the last candle. Do you think the closing price of the next candle will be higher or lower than it is now? What’s next? If you use any analysis tools, what will they tell you? Do you know what the price of the next few candles will be?

Perhaps your various analytical methods, such as technical indicators, trend lines, or candle charts, are telling you how high or low the current price is relative to recent price movements. Perhaps this information can give you an idea of what might happen to the price in the next few minutes/hours/days.

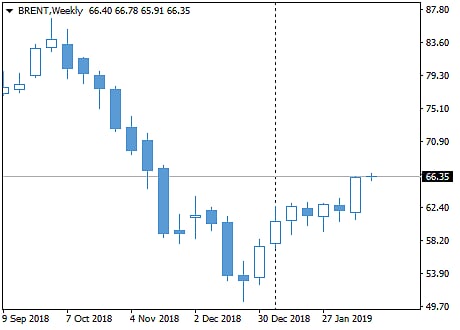

Now try to zoom out the chart or view a longer time frame. Does your theory still hold true, or does the situation start to change when you view more history of the asset on the screen? Perhaps drawing a chart in a longer time frame has included your research on price trends in a shorter time frame. Maybe now you see that the asset is moving lower than in the past, but the resistance point you thought was not so.

Regardless of the angle of view, the transaction is like standing blindfolded somewhere in the mountains. Your feet will tell you how steep the surrounding terrain is, but you don’t know how high up or how far down the road ahead is. Imagine that there is only one way forward. Even if you have walked every step to the top of the mountain (so you already know how far you are from the top), there is still no way to know whether the next step is uphill to the top or let you fall The abyss is shattered to pieces.

This is why historical charts are so compelling because when you see what has happened, they are all certain. On the price chart, everyone can see it at a glance. The price level goes from point a to point b to point c. This seems to be a series of logical steps. We can try to explain and establish a theory after the fact. Of course, the price fell to b because news of this kind and that kind was released almost at the same time. The soaring to point c maybe because XX issued a positive statement in the media, which brought confidence to the market.

The same is true for the chart mode. By observing candlestick patterns and applying technical indicators to historical price movements, it is easy to come to the rules that you think lead to asset price movements. The problem is that these rules only apply to the present, and price behavior often violates the rules of the trading strategy on which you are based. It’s easy to summarize a theory later, but if you try to analyze the current candle’s direction as requested at the beginning of this article, it doesn’t seem so clear, doesn’t it?

In Jack D. Schwager’s “The New Market Wizards: Conversations with America’s Top Traders”, he asked the mathematician and trader William Eckhardt (Willian Eckhardt), why he thinks that 98% of the things that look good on the chart will not work in reality.

His answer is very interesting: “The human mind is used to create patterns. It will see patterns in random data. In other words, you will see more on the chart than you actually have. In addition, we don’t look at the data neutrally, that is, when the human eye scans the chart, it does not give all data points the same weight. On the contrary, it tends to focus on certain outstanding situations, and we tend to form our opinions based on these special situations.”

You see, the candlesticks you look at in order to determine the price trend, the technical indicators and trend lines that you may or may not apply to your chart, the prices you see on the screen, all these things happen in the past. The indicator you draw is a combination of past price data and a specific mathematical function. The candle you use to refer to the price trend and view occurs at a specific time interval, even if the current price you view on the screen is no longer valid Because the market is constantly determining new transactions at new prices.

This is not to say that price charts and technical indicators are useless. Just relying too much on them will give you an illusion about your predictive ability. One of the best ways to prove this to yourself is to repeat the above exercises on a demo account.

Develop your theory based on past data, and then apply it to current price movements, rather than self-doubt or modify your strategy after the fact. Doing so will prove to you that when you apply a strategy that works well on historical data to actual price movements, this strategy may soon fail. Try to come to a conclusion for yourself.

SuperForex Lecture – FX Trading Psychology

Importance of Trading Time Frames

In Nassim Taleb’s work, what I value most is how he uses his iconic dialogue style and simple examples to convey seemingly complex ideas. Here is the second example we quoted from his book “Fooled By Randomness: The Hidden Role of Chance in Life and in the Markets” Whether you are a novice or a veteran, I highly recommend this book.

This example revolves around the time scale you use to monitor your investment and how it largely determines the signal-to-noise ratio you receive. In other words, how much meaningful information can you extract than just observing changes in investment?

In order to convey his message, he made up a happily retired dentist. The career chosen here is not as accidental as elsewhere in the book. He uses the dental career path to reflect a series of life choices and values, including diligence, hard work, and patience. Therefore, we immediately have such a character, who is rational, conservative, and even a little risk-averse.

According to the book, our dentist is an accomplished investor. He manages to earn more than 15% of the U.S. Treasury bonds every year, with a volatility of about 10%.

Considering that 68% of the observed value will fall between -1 and 1 standard deviation, we can expect his return to be between 5% and 25% 68% of the time (15% expected excess return plus Or minus the expected fluctuation of 10%).

If we look at two standard deviations, it will account for 95% of all observations, and we can expect that his portfolio will generate returns between -5% and 35% (15% +/- 20%). This means that in any given year, our retired dentist has a 93% chance of profitability. Yes, I believe you will agree.

Our problem is that our dentist subscribes to an online service that provides him with real-time prices of the financial instruments he trades. So now, as long as he clicks a button, he can check at any time whether his portfolio has risen or fallen.

This is something the dentist doesn’t know…

Although his portfolio has a 93% chance of profitability each year, this proportion drops to 77% per quarter, 67% per month, 54% per day, 51.3% per hour, 50.17% per minute, and 50.02% per second. The shorter the time, the greater the impact of randomness, which is nothing new.

But the real problem is that our retired dentist now has to fight the intense emotional waves he generates when he sees changes in portfolio prices. He couldn’t resist the urge to constantly check his portfolio. Now he is overwhelmed by a lot of useless information, and this information will only confuse him and make him question the original reasonable investment strategy. Every time he perceives a loss, he will become nervous, and every time he perceives again, his mood will improve and he will regain his spirit.

Taleb went on to explain that in every eight hours of monitoring his investment, the retired dentist had 241 minutes of pleasant experiences and 239 minutes of unpleasant experiences. In the course of each year, there were 60,688 minutes of pleasant moments and 60,688 minutes of unpleasant moments. 60,271 minutes. All of this is essentially stupid proof.

In fact, we are more likely to take risks to avoid losses than to gain profits. This is what you need to know what Taleb means in the story of the happily retired dentist.

‘Negative event-related brain potentials… When participants make a loss-causing choice among the two choices, the amplitude will be greater than the amplitude of the choice that leads to gains… When the other choice may produce greater gains, it will not trigger The medial frontal lobe is active, but if another option may cause greater loss, it will trigger the medial frontal lobe activity. Choices made after a loss are riskier than choices made after a profit and are related to more loss-related activities. ‘ (Gailin and Willoughby, 2002).

The research of Galin and Willoughby confirms the views of behavioral economists for decades.

However, the main difference between Taleb’s retired dentist and yours is that Taleb did not mention that the dentist changed his trading strategy based on the negative feedback he received when he checked the performance of the portfolio more frequently.

And how many times have you changed your strategy during trading? How many times has it been caused by some temporary market fluctuations, and if you check your transactions less frequently, you won’t even notice these changes?

The moral of this story is that the shorter the interval between viewing the financial instruments you choose, the more random the price fluctuations you see, which means that you will receive negative feedback more frequently and are more likely to change Your strategy or exit has been a good deal.

Survivorship Bias

In “Fooled By Randomness: The Hidden Role of Chance in Life and in the Markets”, Nassim Nicholas Taleb (Nassim Nicholas) Taleb) tells the story of a mysterious letter that persuades you to invest in the predictive power of offshore trading funds. The beauty of this story is that it illustrates the survival bias very well and perfectly expresses how easy if we are to make mistakes.

You receive a letter from a trading company informing you that a certain market will rise in the next month. Obviously, you suspected that you were deceived, so you ignored this letter, and the prediction of this letter proved to be correct.

Next month, you received another letter from the same company, which said that the market will fall next month. You ignore it again, and it turns out that the prediction is correct again. You received a letter in the third month and the fourth month.

Every time a prediction comes true, you begin to believe in the mysterious company that has been sending you predictions. You may even start to feel a little special because you have been singled out to receive this very valuable market information. You no longer choose to ignore it. Instead, you put all your savings into it, but you never receive a letter again, and you never see your hard-earned money again.

You and a close friend confided your misfortune and discovered that he also received the same letter, but he did not receive the letter after the second month. He tells you that the prediction in the first letter is correct, but the prediction in the second letter is wrong. You quickly figure out what happened.

This scammer has a large number of email addresses from the beginning, such as 10,000. He divided the initial sample into two groups and sent a bullish letter and a bearish letter to the first and second groups respectively. When the market did rise, the group that received the bearish forecast was abandoned, and the remaining 5000 people were the group that received the bullish forecast.

The scammer repeated the process and deleted another 2500 recipients from the second email (the market was a bear market in the second month, so those who received the bullish letter were abandoned). This process was repeated in the 3rd month (allowing 1250 people to receive the correct prediction), and again in the 4th month, 625 people were obtained. Of the 625 victims, you are just one of the hundreds of victims who were defrauded to invest in the fund.

Why did you fall into this trap? The answer is simple, you are fooled by the accuracy of the prediction. why? Because you only saw the correct prediction!

Since we are susceptible to survival bias, we tend to believe in all kinds of things, but what Taleb wants to convey is not only to remind us to avoid being deceived but also to things we take for granted. Random phenomenon.

Taleb said in the book, “I’m not saying that Buffett is not good at investing, but that among a large number of random investors, there will almost certainly be people who get investment records like him by luck alone.”

Therefore, next time you want to use a signal service that claims to be able to predict accurately or want to invest in a fund manager who has outperformed the market for the third consecutive year, ask yourself two simple questions:

- How many signal services or fund managers have failed before I can find this “winner”?

- How likely is the success of this signal service/fund manager to be a purely random result?

Remember, we usually only see “winners”, people who are selected from a large number of possible candidates. The same principle applies to scientific research published in peer-reviewed journals or events reported in the daily evening news. How many studies you have never heard of have failed to find any connection between eating chocolate and longevity? How many stories that are not considered newsworthy did not appear in the news summary last night?

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!