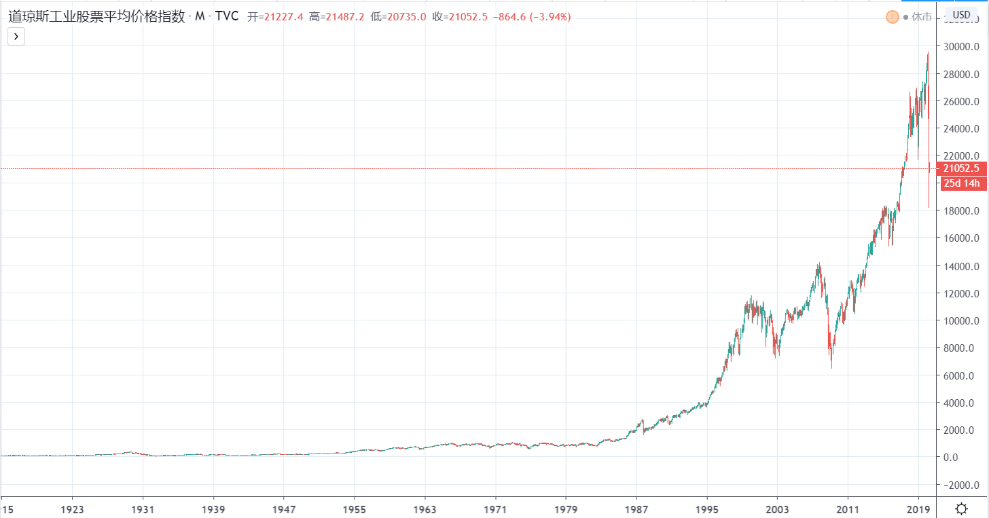

The Dow Jones Industrial Index abbreviated as “Dow”, and the English name is “DJIA (Dow Jones Industrial Average)”, is one of the three major stock price indices in the United States. The Dow was founded in 1885 by Charles Dow, the editor of The Wall Street Journal, and is now managed by S&P Dow Jones Indices LLC. It has a total of 30 constituent stocks, covering 30 of the largest or most well-known listed companies in the United States. The Dow has a long history and strong credibility and is an important indicator of the overall performance of the US industrial market and the stock market.

The Dow is a price-weighted index and is adjusted by the approximate d to deal with sudden changes in the stock price caused by the stock split (as of April 2020, the approximate d is 0.1474). The calculation method is as follows:

Dow = the sum of the unit prices of 30 stocks/d

The biggest one-day decline in the history of the Dow occurred on Monday, October 19, 1987. The decline reached 22.61% on that day, which was called “Black Monday.” The biggest point drop occurred on March 16, 2020. The Dow fell 2,997.10 points on that day or 12.93%.

At the beginning of the establishment, the Dow Jones Industrial Index included 12 companies, all of which were engaged in manufacturing or heavy industries, hence the name “Industrial”, but it has now been expanded To all large companies listed in the United States, including Walmart Inc., McDonald’s, JPMorgan Chase, etc., the historical significance of the word “industry” is greater than the actual meaning. It is worth mentioning that the first 12 companies have all been delisted. Some have been delisted due to bankruptcy like the United States Leather Company, and some have been delisted due to poor management like General Electric Company. The management agency will adjust the list of constituent stocks from time to time according to the performance of the selected company. Since 1928, the total number of constituent stocks of the Dow has remained at 30. Therefore, as long as one of the constituent stocks is delisted, there will be another replacement, such as In 2015, Apple replaced AT&T.

Although the Dow is one of the most closely watched stock prices in the world, there are many criticisms of it. The main focus is on the following two: The

first is its price weighting algorithm. This calculation method will make the price high. The influence of stocks is far greater than that of low-priced stocks. Therefore, even if the company’s market value is similar, a 10% increase in low-priced stocks may not necessarily compensate for the 1% drop in high-priced stocks.

The second is that it contains too few constituent stocks. Many people think that the performance of 30 companies cannot fully represent the U.S. stock market. The failure of one or two high-priced constituent stocks is likely to cause its overall decline. Therefore, it is generally recommended to Refers to a combined analysis with the S&P 500 index.

IronFX

IronFX

Comment by Diletta

March 26, 2024

Awesome bonuses, good leverage. A few hiccups, but support rocks!